There’s been a bunch of discrete but interconnected topics that have been on my mind, and I wanted to attempt to write a post that strings my thoughts on them together. And as a teaser, I promise to explain the meaning of this caption photo below!

Breakneck

First, let’s start with some quick commentary about the book Breakneck: China’s Quest to Engineer the Future by Dan Wang. Dan has a knack for presenting his observations on China via engaging and (often) moving prose. I first learnt of him through his annual letters, and this book is, in his own words, a series of annual letters packaged together. To quote Dan:

The simplest idea I present is that China is an engineering state, which brings a sledgehammer to problems both physical and social, in contrast with America’s lawyerly society, which brings a gavel to block almost everything, good and bad.

Through this lens, the book presents a narrative for the rapid transformation and modernization of China, against the relative stagnancy (or decline?) of the U.S. And as a “subplot”, the book looks at one of the costs of the U.S. offshoring of manufacturing, which is the loss of process know-how in skilled labor: using cooking as a metaphor, you may have the raw ingredients (the capital and resources), the recipe (the IP), but you cannot cook the meal to a high quality unless you have the experience and training as a chef. And what’s worse, the lack of such know-how also prohibits process (and eventually, product) innovation. Fast forward to the present, this is why China is now in the lead in areas like infrastructure, EVs and renewable energy, and thus well-positioned for the AI age.

I’m not here to give a long critique of these ideas – I recommend you to read the book and form your own opinions. At the very least, you’ll probably become a lot more knowledgeable about China1. I think it is useful and explains lots of phenomena, but like many ideas presented in business books, it probably suffers from overfitting and over-generalization. I do think the book is well-timed, as the West – with America at the center – is undergoing a phase of decline in its democratic institutions, a reshuffle of industries and jobs due to globalization, and a form of cultural wars in many areas of society. China is often looked at as a contrast, as it seems to be doing better in many aspects. (For a deeper probe on this contrast, I highly recommend this new essay by Kaiser Kuo – The Great Reckoning: What the West Should Learn from China.)

Western game devs’ setbacks

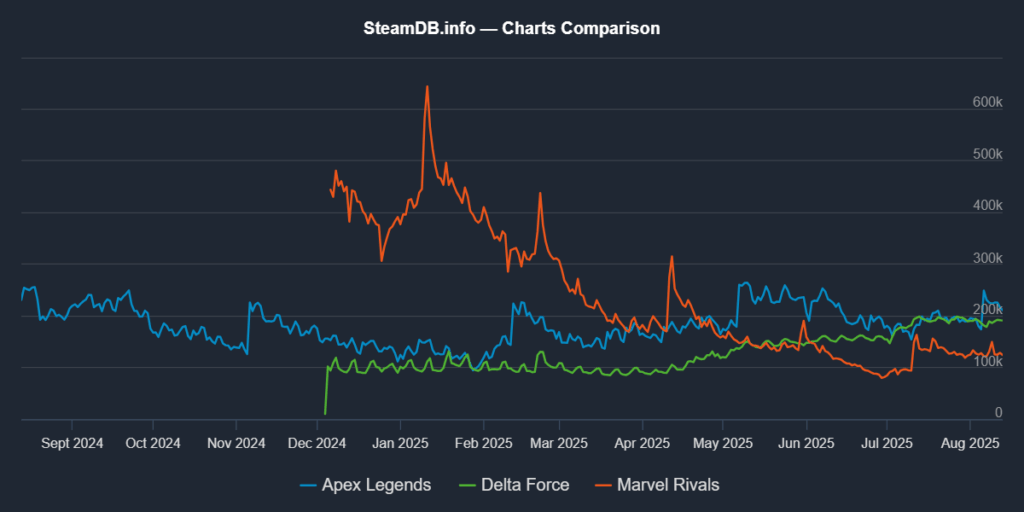

With Breakneck as reference, let’s now talk video games. Western game development, especially U.S. game development, is noticeably going through a contraction after a frothy COVID bubble. There are many reasons for this – frothy VC capital allocation, a corresponding startup bubble, and misguided expansion strategies at many large game companies, to name a few. But it is tempting to also look at the sector as (yet) another example where the advantages have (gradually, then suddenly) shifted to the Chinese ecosystem; indeed, you can argue that’s been a long-term thesis on this very blog.

In recent months, we’ve seen a wave of high-profile Western gaming startups announce closures or have products “flop” in the market. This is both due to a funding crunch by VCs who’ve flocked away from their brief infatuation with gaming, and developers who’ve misjudged their runway and (grossly) overestimated their chances of success with their first releases. The old-fashioned way of iterating through smaller successes2 is in conflict with the VC model, at least given the sums raised (in some cases, with only a powerpoint deck). Founders also seem to have forgotten even some of the biggest venture-backed successes of the 2010s, for example Riot and Supercell, had typical crisis moments (and pivots) in their early years.

Some of the studios who have shuttered can blame a bit more on bad timing. They started towards the end of the bubble, and therefore received smaller amounts in backing. Having only been around for about 2 years with little hope to extend their runway, these studios would have some merit in saying they didn’t have enough time to ship something. But “enough time” is relative; “work expands to fill the time available”, and we are now witnessing a cold demonstration of this law in reverse.

996 is not the answer

996 is an idea that China is already rejecting; curiously, the West is now looking at it as one path to salvation. I can’t help but share some thoughts here.

For one thing, it’s arguable how effective mandatory overtime like 996 ever really was. I’ve worked 80-hour weeks before, and I’ve also seen 996 in action at some large Chinese game studios. There is a lot of slack in those supposedly 12-hour workdays, because workers figure out all sorts of ways to relax (otherwise they will quickly burn out). A real 12-hour day thus could look something like this:

- day starts at 9:30 – 10am (or even later, depending on how late the team worked the previous day)

- 11:30am – lunch time, followed by official nap-time til 2pm (lights are turned off in the whole office)

- 2 – 6pm afternoon work time

- 6-7pm dinner and break

- 7pm – however late: depends on how much pressure the team is under

Now, there are famous cases where teams worked around-the-clock and delivered big successes – PUBG Mobile was shipped in just a few months, and their daily playtest often happened around midnight. But the graveyard is also full of games where teams hustled just as hard to no result. Partly as a result, attitudes have been shifting. Nowadays, 996 is increasingly being rejected by the younger generation entering the workforce – I recently even visited a startup in Shanghai where their official policy is a 4-day week.

Secondly, working long hours isn’t a foreign concept anywhere. Back when I was a fresh grad, consulting and investment banking were often the most sought-after jobs, and those were often celebrated as 80-hour-week careers. It seems that 996 is just the latest exotic phrase borrowed by Silicon Valley to advance its hustle-culture. There’s some irony in how we seem to have gone full-circle: before tech became the most sexy jobs for young college grads, consulting & i-banking glamorized “work hard, play hard”; then Google popularized the cushy office perks in the talent wars, which eventually bred entitlement and complacency; and now comes 996 to save the day…

Be curious about China, but look deeper

I don’t think it’s a bad thing that China is now often looked at with a mix of envy and fear from the West. In some ways, this is a begrudging (and belated) sign of respect. And perhaps in a unfashionably cosmopolitan perspective, free competition, and learning from each other, is how progress for all of us will accelerate.

But I would certainly caution against looking at China and taking away superficial lessons (like 996), or magical-thinking style narratives. Take the caption photo for example. Shared bikes are common enough in many parts of the world these days. And arguably it’s one of the first widespread examples of the West importing a Chinese innovation. But uniquely, China seems to have the worst of it when it comes to waste with shared bikes. They are undoubtably over-supplied, and clog up valuable side-walk real-estate3. There’s little sign of progress a decade after their initial appearance, and the market has gone stagnant with entrenched vendors.

“Brute force” is an apt (and often used) description for how problems are solved in China. In the above example, it’s also how negative externalities are created. I see similar phenomena in the local games industry. Borrowing a meme – for questions like “what live-ops tools do we need in our game?” or “which of these features should we build?”, the Chinese dev team’s answer is (too) often simply “yes.” Take the recent gameplay trailer for Ananta from Netease:

The game is incredibly ambitious, looks great already, and apparently was quite a sensation at this year’s TGS. But it also seems that the devs have a “brute-force” approach to content and mechanics, which creates unrealistic expectations (the Youtube comments are hilarious), and may well crush the game under its own weight. Sorry if I sound too negative – but if I’m promised “Everything: the Game”, the odds are I’ll be disappointed…

There are teams moving in the opposite direction. Young people leaving prestigious big studios to make smaller-scope (e.g. PC single-player) games; incubators that cater to such inexperienced new teams are also appearing. I feel Chinese developers have often admired the western indie scene for its creativity (and purity in goals); perhaps we will see a Chinese indie flourish soon.

- This assumes you are a “Western audience.” ↩

- Blizzard started out doing porting contracts in the 90s; it was only with the 3rd iteration of The Witcher that CDPR became a household name with gamers. For a Chinese example, Genshin was miHoYo’s 5th game, shipped in the 9th year after the company’s founding. ↩

- I suspect the road where I took the photo, which is not a busy foot-traffic street, is used as a dumping ground to reallocate bikes. ↩